Credit Building Loans

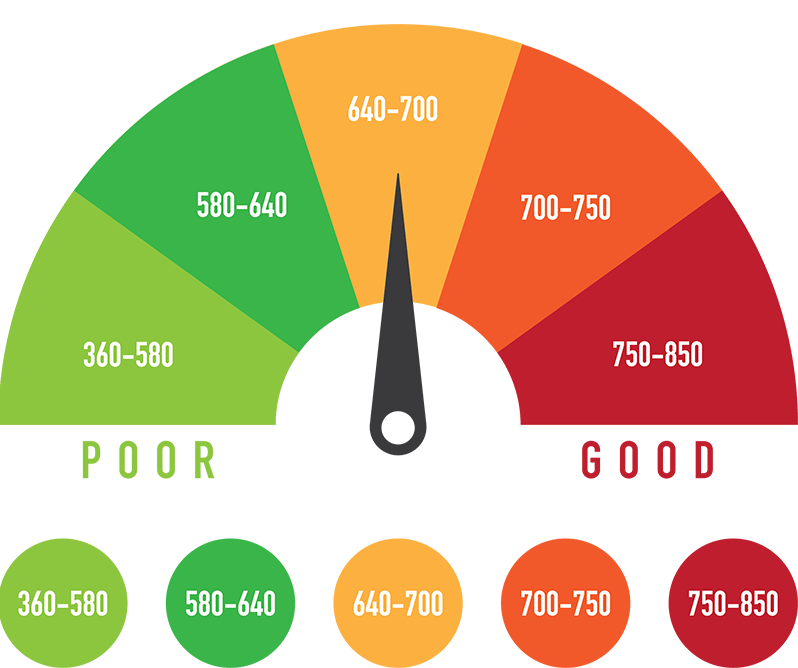

Credit Builder loans are loans that can be used to grow a consumer’s credit score. These loans can be secured or unsecured. Secured means that you the borrower are pledging money or other collateral such as a car. Unsecured means that you are offering no collateral.

Unsecured loans are more challenging to qualify for if you have challenged credit. It is important to maintain a healthy mix of revolving and installment debt. Credit cards and lines of credit are considered revolving while signature loans are considered installment. These are all examples of the types of loans you can use to build your credit. Making all payments on time are important when you are trying to grow your credit.

Membership Required. Join Now.